Startup Projections Wrap Up

In Our Love/Hate Relationship with Projections I talked about the challenges of creating startup projections, and why most of the current advice is wrong.

Then I introduced The Projection Canvas as a practical tool founders can use to help talk about the financial story of their startup without getting lost in irrelevant details.

To show how this can be used in real life, I shared two case studies including completed Projection Canvases and sample spreadsheet models.

In this wrap-up post I complete the picture and show what a hypothetical Financials slide would look like in a pitch deck.

I also talk about the inherent connections between your financial story and your overall pitch.

How to create your financials slide

Whether you believe financial projections are a waste of time or extremely important, we can all agree that Financials slides can be much, much better.

Use the Projection Canvas to make sure your Financials slide tells the right story.

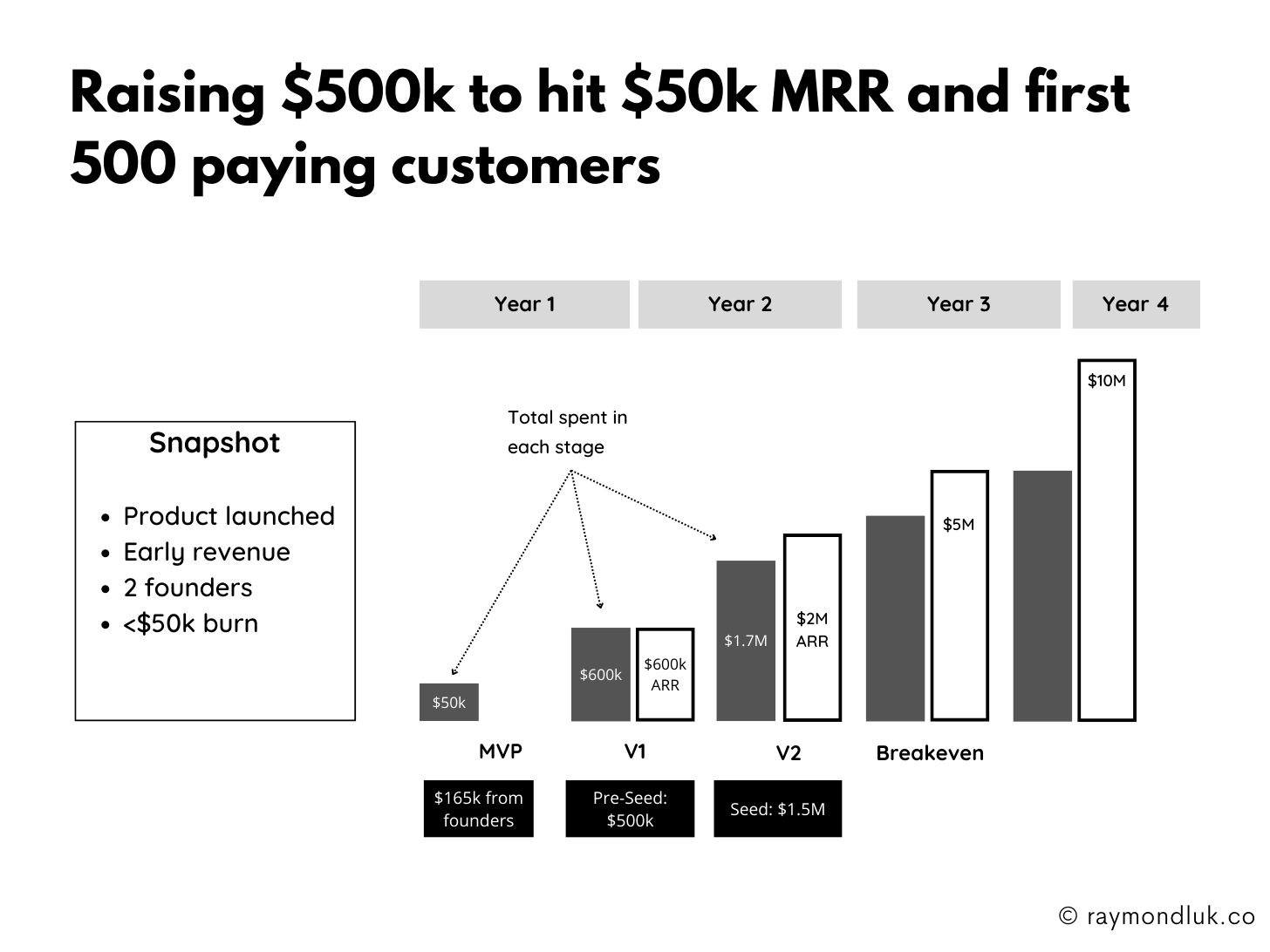

Example 1

This is what the canvas and sample projections looked like for our early-stage software startup:

Turning this into a Financials slide on a pitch deck is easy because we’ve already done the work on the Projection Canvas to capture the key points:

I based the slide on the best case scenario in my projections. You’ll notice a few non-standard (in a good way) things:

The phases (MVP, V1, V2) do not line up with years. That’s because annual financials are an accounting convention, not the way your startup will grow.

I used total expenses in one bar, but ARR in the other (😮). That doesn’t make sense if you are accounting for profit/loss (we aren’t), but it does if you are focusing on what revenue level you will achieve.

There’s a lot of detail in a spreadsheet that’s not on this slide. What this does is focus the conversation on what can be achieved, and when. Eg it’s easy to see at a glance the founders think this could be a $10M ARR business within 3-4 years but it will be done at a low burn rate, even achieving breakeven within 2-3 years.

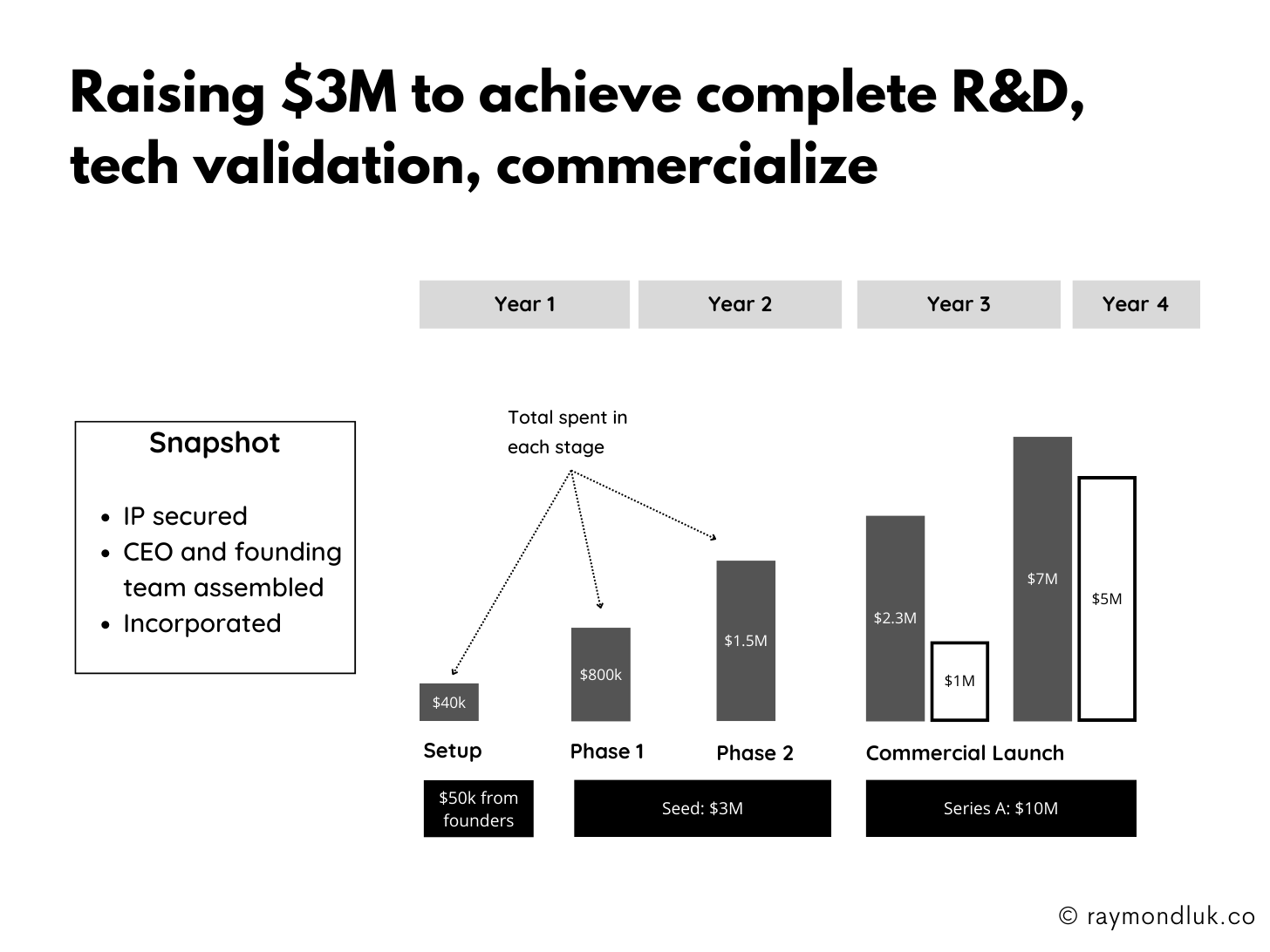

Example 2

Here is the Projection Canvas and spreadsheet from our University-spinoff example:

Here is an example of what this startup’s Financials slide could look like:

Again, the phases do not line up with years, which is ok. It’s easy to see that this is a company that is not expecting revenue for years due to the high up-front R&D costs.

Unlike the software example, where revenue and usage will be front and center, this slide will drive a different conversation. It focuses on how important those technical validation stages are and whether this startup can raise enough money to get there.

How your projections fit with your overall pitch

I wrote an article about how to make a pitch deck more cohesive, i.e. more connected. One thing founders forget is how important each element of a pitch is connected to all the other elements.

That’s true of your financial projections.

Now that you’ve spent the time to develop them you should make sure your financial story fits your overall story.

Problem-Solution

Let’s say you’ve identified a huge, painful problem. The solution you’ve created is both novel and difficult for others to copy.

Your projections need to say, “we need to invest in R&D, this is going to take time to bring to market.” This is closer to the University spinoff example than the lean startup example.

Market Size

If you’re saying there is a huge TAM for your product, you’re saying the market is huge and untapped. But if you’re projecting slow growth, be prepared for a lot of questions.

This is one advantage of a Projection Canvas vs. financial projections. You aren’t limited by what is achievable with funding you think you can get.

Show future phases that are big and exciting.

Go to Market

The tactics you use to graduate from stage to stage are your go to market strategy. Each stage will have new and different tactics.

Make sure what you show in your GTM slide fits with what’s on our Projection Canvas.

Ask

When you ask for the money you’re asking for funding that helps your startup jump to a new phase of growth. The Projection Canvas makes that part easy.

Instead of talking about how many engineers you’ll hire in your use of proceeds, use this slide (usually the last one in your deck) as a launchpad to talking about what’s next for your company.

How different does your company look and how much bigger is the opportunity as a result of this funding?

A final word of advice for investors

I wanted to conclude this series some advice for investors.

DO ask to see projections. There’s a lot of signal in that noise and it’s your money after all.

DON’T put pressure on founders to be so predictable. It’s great when things work out as projected. But they rarely do. Sometimes when things don’t work out as projected, they end up being much better.

I often describe discussions about projections as two people lying to each other.

The essential parts of financial projections are the founder’s thesis about how they see the world, and how they intend to disrupt it. As an investor, their thesis may not match your thesis.

But it’s not a bad idea to remind them that neither one of you is likely correct.

That is a better way to start a conversation around financial projections.

Resources

Click here to download the Projection Canvas template and other resources.

Download the spreadsheet examples